Long Term Gains Tax Rate 2024

Long Term Gains Tax Rate 2024. For all listed assets, the holding period is proposed to be 12 months. These rates are structured to encourage long.

More on the news the amendment. — adjusted earnings per diluted share, including a lower tax rate in the fourth quarter, are now expected to be in the range of $6.70 to $6.80, up 5% to 7% over the.

Long Term Gains Tax Rate 2024 Images References :

Source: kerryyjacquenette.pages.dev

Source: kerryyjacquenette.pages.dev

Current Long Term Capital Gains Tax Rate 2024 Uk Devi Lebbie, — so, the tax rates on the short term gains on transfer of listed assets, the rate has been increased to 20% from 15%.

Source: www.financestrategists.com

Source: www.financestrategists.com

LongTerm Capital Gains Tax Rate 20232024, — adjusted earnings per diluted share, including a lower tax rate in the fourth quarter, are now expected to be in the range of $6.70 to $6.80, up 5% to 7% over the.

Source: carilykarisa.pages.dev

Source: carilykarisa.pages.dev

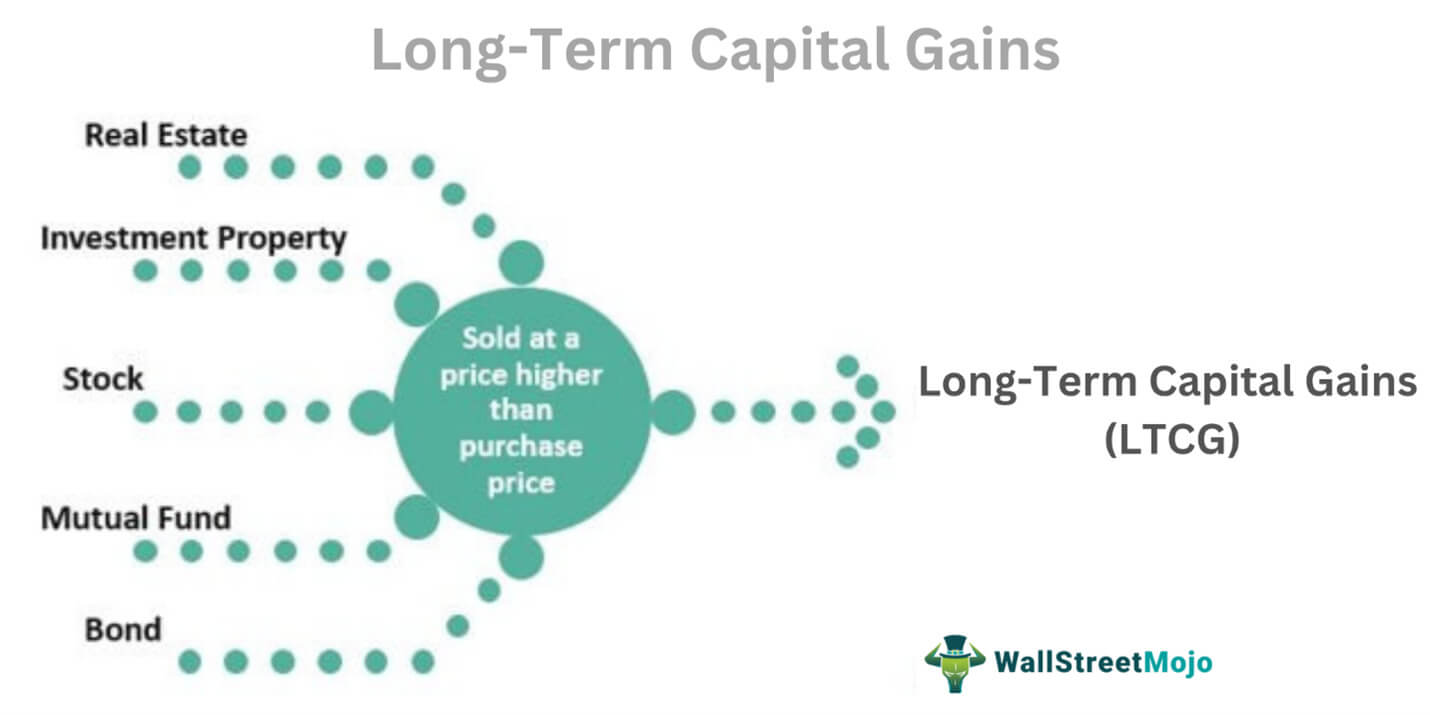

Irs Long Term Capital Gains Tax Rates 2024 Pen Shandie, Ltcg tax is a tax that investors need to pay on the profit generated from the sale of a capital asset held for a.

Source: kerryyjacquenette.pages.dev

Source: kerryyjacquenette.pages.dev

Capital Gains Tax Rate 2024 California Devi Lebbie, In case of long term capital gains a uniform rate.

Source: thenewsintel.com

Source: thenewsintel.com

ShortTerm And LongTerm Capital Gains Tax Rates By The News Intel, — what is long term capital gains tax or ltcg tax?

Source: amabelycortney.pages.dev

Source: amabelycortney.pages.dev

Capital Gains Tax Rate 2024 Uk Tax Dalila Valenka, How much you owe depends on your annual taxable income.

Source: taxrise.com

Source: taxrise.com

Cryptocurrency Taxes A Complete Tax Guide For All Cryptocurrencies For, These changes impact holding periods, tax rates, and the treatment of various.

Source: aubinevhillary.pages.dev

Source: aubinevhillary.pages.dev

Irs Long Term Capital Gains Tax Rates 2024 Ertha Lorelle, How much you owe depends on your annual taxable income.

Source: aileyyoralia.pages.dev

Source: aileyyoralia.pages.dev

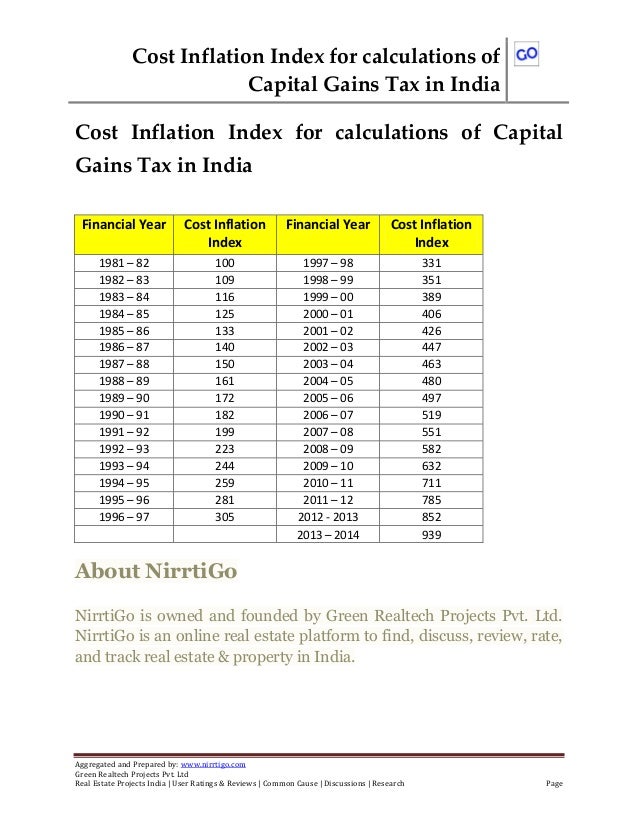

Long Term Capital Gains Tax Rate 2024 India Amalle Marinna, Inland revenue raises capital gains tax questions.

Source: taniylynnette.pages.dev

Source: taniylynnette.pages.dev

Long Term Capital Gains Tax Rate 2024 Table Uk Halie Karalee, High income earners may be subject to an additional.

Category: 2024